ReconArt World Class Reconciliation Software

As a result, you will gain quick visibility into your aging analysis and process improvement. We will now explore our top six list of the best accounts reconciliation software. We explain their top features, integrations, pricing, and customer reviews, among other aspects. This thorough investigation will help you make an intelligent decision when choosing the software for yourself. Accounts reconciliation is tiresome, whether you are a solopreneur, a small business owner, a freelancer, or the head of a large enterprise.

Automated reconciliation

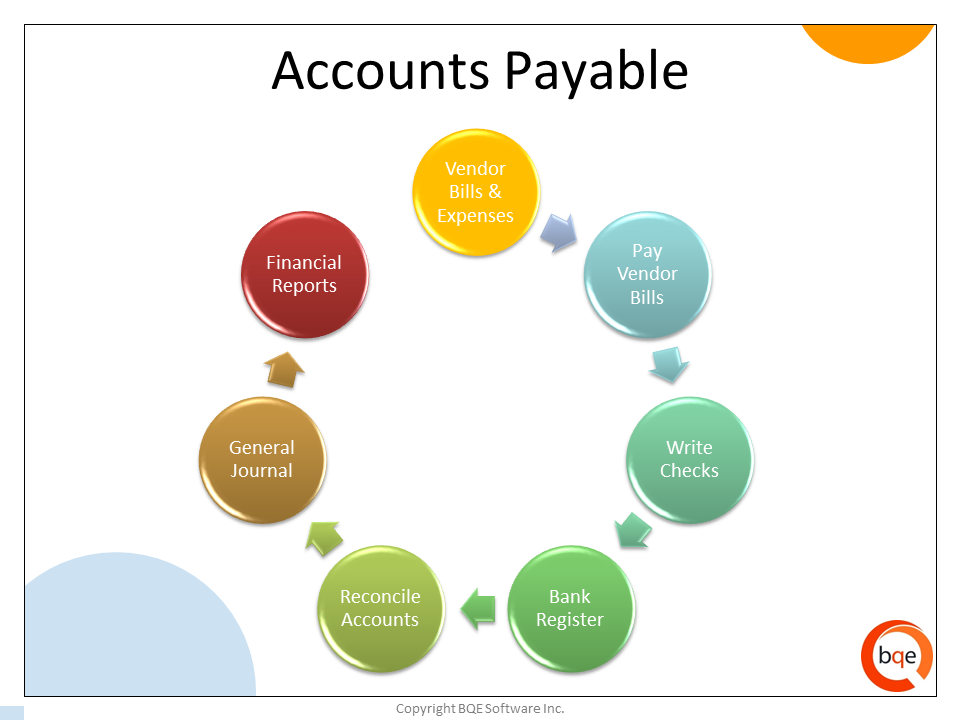

However, it’s essential to ensure seamless integration with current systems and provide adequate training for employees during the transition. Account reconciliation is a fundamental yet often intricate task in financial management. With increasing transactional volumes and complex financial architectures, account reconciliation software has become indispensable https://www.intuit-payroll.org/ for many businesses. In essence, if you’re seeking increased accuracy, efficiency, and scalability in your financial operations, account reconciliation software can be a game-changer. Whether driven by growth, complexity, or the desire for refined financial governance, the right software can significantly uplift your reconciliation processes.

NCH Express Accounting Software: Best Bank Reconciliation Software for Desktop

Workiva is a cloud-based software that offers a range of financial management tools, including an account reconciliation module. Workiva’s account reconciliation module is designed to simplify the reconciliation process by automating manual tasks and eliminating errors. With Workiva, you can quickly reconcile your accounts and ensure the accuracy of your financial data. BlackLine is a cloud-based financial automation software that offers a range of tools to streamline your accounting processes. One of its most significant features is its account reconciliation module, which automates the process of reconciling accounts, including bank accounts, credit cards, and general ledger accounts.

What is the best bank reconciliation software?

As a result, you can speed up your transaction processing, resolve any issues as they arise, and have all the required financial information available at your fingertips. Xero, an excellent accounting software popular for its inventory and project accounting, also offers exceptional bank reconciliation features. Its interface is easy to manoeuvre, with its side-by-side layout enabling easy matching of bank transactions against accounting records and highlighting unrecorded transactions. Most accounting software, such as QuickBooks, FreshBooks, and Zoho Books, have in-built bank reconciliation solutions.

Xero is an web based intuitive accounts reconciliation software that provides multiple bookkeeping functionalities. This app can automate your reconciliation process while improving accuracy and transparency. Using this tool means automating your invoicing system and accepting online payments. It automates repetitive processes, allowing you to conduct several tasks in minimal time.

However, its score took a hit because it doesn’t allow bank feed imports and automatic matching. There’s no option to connect a bank account to NCH Express Accounts https://www.kelleysbookkeeping.com/how-to-calculate-beginning-year-accumulated/ and users have to manually match all transactions every reconciliation period. If these features are essential to your business, we recommend QuickBooks Online.

NCH Express Accounts is a locally installed accounting software with a free version that you can use for bank reconciliation. Although it’s not as full-featured as QuickBooks Online and Xero, it can be sufficient for businesses with lower transaction volumes. It has a free plan, but you can upgrade to a paid version to access additional features, such as billing, invoicing and check printing.

Customers must have access to different support channels for maximum flexibility. Our ease of use evaluation focused on the overall user experience in performing bank reconciliations. We subjectively rated the overall look of the reconciliation screen, the layout and presentation of the reconciliation report, and difficulty of using the bank reconciliation module. Sage Intacct integrates with CRM, HR, and eCommerce platforms, making it easier for businesses to manage their finances across different departments. It verifies the accuracy of account balances by comparing a company’s internal records with those in its external accounting system.

- Besides that, QuickBooks Online remains our top pick even though ReconArt received perfect marks in bank reconciliation features.

- Reconciliation provides a clear picture of your financial position, enabling better planning and budgeting.

- Its retail solution, for example, includes CRM, inventory management and marketing features to integrate with its accounting platform.

- You can count on this tool to keep comprehensive records, conduct single-click bank reconciliation and gain clear insights into your financial condition.

It minimises the need for manual intervention by automating transaction matching across multiple sources. Crush complexity, reduce uncertainty, and illuminate data with access to best-in-class automated insights and planning, budgeting, forecasting, reporting, and consolidation functionalities. Prophix is a private company, backed by Hg Capital, a leading investor in software and services businesses. More than 3,000 active customers across the globe rely on Prophix to achieve organizational success.

For instance, if you need bank reconciliation built into a complete general accounting solution, consider QuickBooks or Xero. If your focus is reconciliation, you may consider standalone software like ReconArt or BlackLine. The reconciliation of accounts receivable refers to the process of matching the unpaid invoices or customer bills to the total accounts receivable amount mentioned in the general ledger. The comparison helps ensure that the figures in the public ledger for receivables are accurate and justified. It also matches your vendor statements with the internal record of account payables. All these processes are completed through an automated system, reducing the time you have to spend on the task.

Xero can also integrate with third-party applications and online services, including Cube. They offer a 30-day free trial or 50% off the first three months when you purchase a plan. While the process can be time-consuming and tedious, there are some great software options to help. Accelerate your planning cycle time and budgeting process to be prepared for what’s next. Connect and map data from your tech stack, including your ERP, CRM, HRIS, business intelligence, and more. Sync data, gain insights, and analyze business performance right in Excel, Google Sheets, or the Cube platform.

Xero’s score is a bit behind QuickBooks Online because Xero lacks automatic matching and the ability to add ending balance in reconciliation. It doesn’t have a counterpart to QuickBooks Payments that allows QuickBooks Online to match all payments that go through QuickBooks Payments automatically. But setting that aside, both QuickBooks Online and Xero go head-to-head in bank reconciliation features. Intuit QuickBooks is a financial accounting software program developed by Intuit. QuickBooks offers a range of features for small businesses, including bookkeeping, invoicing, and payments. Account reconciliation software will help optimize how your reconciliations are presented, which will help improve the quality and accuracy of your financial data.

The interface design is traditional and some users–especially those with less than perfect eyesight or little knowledge in accounting–may find it too difficult to use. If you want software with an easy-to-understand interface, we recommend Xero because it presents reconciling items in a side-by-side presentation. All ReconArt plans are web-based and work with any ERP solution, accounting system, and external data sources. However, if you’re looking for a more sophisticated reconciliation software, we recommend ReconArt. We also employ a comprehensive editorial process that involves expert writers, which ensures that articles are well-researched and organized, offering in-depth insights and recommendations.

Not many people will claim to like comparing bank statements and invoices for long hours only to run into unexpected errors. Financial closing is complicated to begin with, and when done manually, it can consume your time and expose you to mistakes. Oracle NetSuite vs. ProphixAs an all-in-one cloud business management solution, Oracle NetSuite may be excessive for organizations primarily looking to optimize financial processes. Xero’s accounting software is one of the most popular choices for managing just about any accounting process for many organizations, though it’s tailored to small and medium-sized businesses. Automated, paperless record keeping is effortless in Xero, making it a good candidate for account reconciliation. Financial data is an essential asset for all departments, but it’s often trapped in finance processes.

It allows you to compare data from various systems and locations to reconcile account balances on all your balance sheet accounts. You can also delegate tasks to your team members; it mainly comes in handy when you want to define duties for your accounts team. ZarMoney upgrades your accounting process thoroughly through the power of automation. It introduces efficiency and fixed asset turnover ratio formula calculator accuracy into your accounts reconciliation system, freeing up your hours so you can focus on other tasks. You can count on this tool to keep comprehensive records, conduct single-click bank reconciliation and gain clear insights into your financial condition. Prophix One is a fully integrated, automated platform that’s your best choice for account reconciliation software.